Facing a mountain of tax debt can feel overwhelming, but you don’t have to navigate these troubled waters alone. Tax relief companies can help negotiate with the IRS to potentially reduce what you owe or create manageable payment plans. However, not all tax relief experts deliver on their promises, and some charge exorbitant fees with minimal results.

Our comprehensive analysis of tax relief experts reviews reveals which companies truly stand out in 2024. We’ve evaluated their success rates, fee structures, customer satisfaction, and professional credentials to help you make an informed decision during this stressful time.

How We Evaluated Tax Relief Companies

To provide the most accurate and helpful tax relief experts reviews, we developed a rigorous methodology that examines multiple factors. Our research team analyzed data from various sources, including customer testimonials, Better Business Bureau ratings, and direct consultations with these companies.

Our Ranking Criteria

- Professional Credentials: We verified the qualifications of staff, including tax attorneys, CPAs, and enrolled agents authorized to represent clients before the IRS.

- Success Rate: We analyzed the company’s track record in reducing tax debts and resolving IRS issues.

- Customer Support: We evaluated responsiveness, availability, and quality of communication throughout the tax relief process.

- Fee Structure: We examined pricing transparency, value for money, and whether fees are reasonable relative to potential savings.

- Client Satisfaction: We analyzed verified customer reviews from multiple sources, including the Better Business Bureau and TrustPilot.

Our Top Tax Relief Experts Picks for 2024

After thorough research and analysis of tax relief experts reviews, we’ve identified the top companies that consistently deliver results for their clients. Each of these firms offers free consultations and employs qualified tax professionals who can help resolve your tax issues.

| Company | Minimum Debt | Fees | Money-Back Guarantee | BBB Rating | Staff Credentials |

| Optima Tax Relief | $10,000 | $2,000-$7,000 | 15 days | A+ | Tax Attorneys, CPAs, Enrolled Agents |

| Anthem Tax Services | $10,000 | $3,000+ | 100% (no time limit) | A+ | Tax Attorneys, CPAs, Enrolled Agents |

| Community Tax | $10,000 | $2,000-$7,000 | 14 days | A+ | Tax Attorneys, CPAs, Enrolled Agents |

| Fortress Tax Relief | $10,000 | $1,000-$15,000 | Initial phase only | A+ | Tax Attorneys |

| Larson Tax Relief | $20,000 | $2,500+ | 15 days | A+ | Enrolled Agents |

1. Optima Tax Relief: Best Overall Tax Relief Service

Founded in 2011, Optima Tax Relief has quickly established itself as a leader in the tax relief industry. With over 1,000 employees nationwide, including tax attorneys, CPAs, and enrolled agents, Optima has the resources and expertise to handle complex tax issues.

Pros

- Comprehensive two-phase resolution process

- Staff includes tax attorneys, CPAs, and enrolled agents

- 15-day money-back guarantee during investigation phase

- A+ BBB rating with accreditation

- Mobile app for document submission and case tracking

- Handles both federal and state tax issues

Cons

- Higher fees than some competitors

- Money-back guarantee limited to investigation phase

- Some customers report communication issues

- Minimum $10,000 tax debt requirement

Services Offered

- Offer in Compromise: Negotiating with the IRS to settle your tax debt for less than the full amount

- Installment Agreements: Setting up manageable payment plans with the IRS

- Penalty Abatement: Reducing or eliminating penalties on your tax debt

- Tax Lien Removal: Working to remove tax liens from your property

- Wage Garnishment Release: Stopping the IRS from taking money from your paycheck

- Audit Representation: Professional representation during IRS audits

Customer Reviews

Get Help With Your Tax Debt Today

Optima Tax Relief offers a free consultation to discuss your tax situation and potential solutions.

2. Anthem Tax Services: Best Money-Back Guarantee

Anthem Tax Services stands out for its industry-leading money-back guarantee with no time limit. If they don’t improve your tax situation, you get a full refund. This level of confidence in their services has earned them high marks in tax relief experts reviews.

Pros

- Unlimited money-back guarantee if your tax situation doesn’t improve

- Experienced staff with tax attorneys and CPAs

- Specializes in wage garnishment and tax levy release

- A+ BBB rating

- Available in all 50 states

- Multiple professional memberships including NATP and NAEA

Cons

- $10,000 minimum tax debt requirement

- Monthly income requirement of $2,000

- Some customers report longer resolution times

- Higher starting fees (around $3,000)

Services Offered

- Tax Settlement: Negotiating with the IRS to reduce your total tax liability

- Wage Garnishment Release: Stopping the IRS from taking money from your paycheck

- Bank Levy Release: Preventing the IRS from seizing money from your bank accounts

- Tax Lien Withdrawal: Removing tax liens from your property and credit report

- Penalty Abatement: Reducing or eliminating penalties on your tax debt

- Audit Defense: Professional representation during IRS audits

Customer Reviews

Take Advantage of Anthem’s Guarantee

Get a free consultation with Anthem Tax Services and learn about their unlimited money-back guarantee.

3. Community Tax: Best for Comprehensive Tax Services

Community Tax offers a full spectrum of tax services beyond just tax relief, making them an excellent choice for those who need ongoing tax support. Their three-step resolution process includes investigation, resolution, and protection to ensure long-term tax compliance.

Pros

- Comprehensive tax services including preparation and bookkeeping

- Relatively affordable fees starting at $2,000

- 14-day money-back guarantee

- Bilingual services available (English and Spanish)

- Mobile app for document submission and case tracking

- A+ BBB rating

Cons

- Not available in Minnesota

- Limited state tax relief options

- $10,000 minimum tax debt requirement

- Some customers report slow follow-up communication

Services Offered

- Tax Resolution: Comprehensive IRS and state tax debt resolution

- Tax Preparation: Annual tax return preparation services

- Bookkeeping: Ongoing financial record-keeping for individuals and businesses

- Tax Assurance: Proactive tax planning to prevent future issues

- Business Services: Specialized tax help for small businesses and self-employed

- IRS Transcript Analysis: Review of your IRS account to identify issues

Customer Reviews

Get Comprehensive Tax Help

Community Tax offers a free consultation to discuss your tax situation and their full range of services.

4. Fortress Tax Relief: Best for Complex Tax Issues

Fortress Tax Relief specializes in handling complex tax cases with their team of experienced tax attorneys. Established in 2003, they have a long track record of successfully resolving difficult tax situations, particularly for clients with substantial tax debts.

Pros

- Cases handled exclusively by qualified tax attorneys

- Extensive experience with complex tax issues

- 500-hour training program for all new attorneys

- Money-back guarantee during initial phase

- A+ BBB rating

- High success rate with difficult cases

Cons

- Higher fees ($1,000-$15,000) than some competitors

- Limited money-back guarantee

- $10,000 minimum tax debt requirement

- May be overqualified for simple tax issues

Services Offered

- Complex Offer in Compromise: For difficult settlement cases

- Business Tax Resolution: Specialized help for business tax issues

- Payroll Tax Problems: Resolution for business payroll tax issues

- Tax Court Representation: Legal representation in tax court

- IRS Appeals: Appealing unfavorable IRS decisions

- Innocent Spouse Relief: Help for spouses not responsible for tax debt

Customer Reviews

Get Expert Attorney Representation

Fortress Tax Relief offers a free consultation with a tax attorney to discuss your complex tax situation.

5. Larson Tax Relief: Best for Business Tax Issues

Family-owned Larson Tax Relief has been in business since 2005 and specializes in helping businesses with tax problems. Their team of enrolled agents has extensive experience with payroll tax issues, business tax debt, and emergency tax situations requiring immediate intervention.

Pros

- Specializes in business tax issues and payroll tax problems

- Experienced enrolled agents with IRS representation rights

- 15-day money-back guarantee

- Emergency tax situation response

- A+ BBB rating

- Available in all 50 states

Cons

- Higher minimum tax debt requirement ($20,000)

- No tax attorneys on staff (only enrolled agents)

- Relatively short money-back guarantee period

- Less focus on individual tax issues

Services Offered

- Business Tax Resolution: Specialized help for business tax issues

- Payroll Tax Problems: Resolution for unpaid payroll taxes

- IRS Revenue Officer Assistance: Help with assigned revenue officer cases

- Emergency Tax Situations: Rapid response for immediate tax threats

- State Tax Issues: Resolution for state tax problems

- Tax Lien and Levy Release: Removing liens and stopping levies

Customer Reviews

Get Help With Business Tax Issues

Larson Tax Relief offers a free consultation to discuss your business tax situation.

Understanding Tax Relief Services

Tax relief services help taxpayers resolve issues with the IRS or state tax authorities. These companies employ tax professionals who negotiate with tax agencies on your behalf to potentially reduce your tax debt, set up payment plans, or address other tax problems.

Common Tax Relief Options

Offer in Compromise

An agreement between you and the IRS to settle your tax debt for less than the full amount owed. This option is typically available if paying your full tax liability would create financial hardship.

Installment Agreement

A payment plan that allows you to pay your tax debt over time through monthly payments. This doesn’t reduce the amount owed but makes it more manageable by spreading payments over several years.

Penalty Abatement

The removal of penalties assessed by the IRS, which can make up 25% or more of your total tax bill. This is often available for first-time offenders or those with reasonable cause for non-compliance.

Currently Not Collectible

A status granted when you can prove to the IRS that you cannot afford to pay your tax debt. This temporarily halts collection activities but doesn’t eliminate the debt.

Tax Lien Withdrawal

The removal of a tax lien from your property and credit report. This can improve your credit score and make it easier to sell property or obtain financing.

Innocent Spouse Relief

Protection for taxpayers who filed joint returns but were unaware of errors made by their spouse. This can relieve you of responsibility for taxes, interest, and penalties.

Red Flags: How to Avoid Tax Relief Scams

Warning: The Federal Trade Commission has issued alerts about fraudulent tax relief companies that charge high fees but deliver few results. Be vigilant when selecting a tax relief service.

Watch Out for These Warning Signs

- Guaranteed Results: No company can guarantee specific outcomes with the IRS. Be wary of any firm promising to settle your tax debt for “pennies on the dollar.”

- Large Upfront Fees: Legitimate companies typically charge a modest investigation fee before full representation fees.

- No Free Consultation: Reputable tax relief companies offer free initial consultations to assess your situation.

- High-Pressure Sales Tactics: Be cautious of companies pushing you to sign up immediately without thoroughly explaining their process.

- No Tax Professionals: Verify that the company employs qualified tax attorneys, CPAs, or enrolled agents.

- No BBB Accreditation: Check the company’s Better Business Bureau rating and accreditation status.

- Unsolicited Contact: Be suspicious of companies that contact you first through cold calls or unsolicited emails.

Tax Relief Services Comparison

Different tax relief companies specialize in various aspects of tax resolution. Use this comparison to identify which service best matches your specific needs.

| Service | Optima Tax Relief | Anthem Tax Services | Community Tax | Fortress Tax Relief | Larson Tax Relief |

| Offer in Compromise | ✓ | ✓ | ✓ | ✓ | ✓ |

| Installment Agreements | ✓ | ✓ | ✓ | ✓ | ✓ |

| Penalty Abatement | ✓ | ✓ | ✓ | ✓ | ✓ |

| Tax Lien Removal | ✓ | ✓ | ✓ | ✓ | ✓ |

| Wage Garnishment Release | ✓ | ✓ | ✓ | ✓ | ✓ |

| Audit Representation | ✓ | ✓ | ✓ | ✓ | Limited |

| Business Tax Issues | Limited | ✓ | ✓ | ✓ | ✓ |

| Tax Preparation | Limited | ✓ | ✓ | No | Limited |

| State Tax Issues | ✓ | ✓ | Limited | ✓ | ✓ |

Frequently Asked Questions About Tax Relief

Are tax relief companies worth it?

Tax relief companies can be worth the investment if you owe a significant amount (typically ,000 or more) and lack the expertise to negotiate with the IRS yourself. Professional representation may help secure better terms than you could achieve on your own, especially for complex cases.

However, if you owe less than ,000 or have a simple case, you might be better off working directly with the IRS to set up a payment plan or exploring other options without paying for third-party assistance.

How much do tax relief companies charge?

Tax relief companies typically charge between ,000 and ,000 for full representation, depending on the complexity of your case and the amount of tax debt. Most companies charge an initial investigation fee (0-0) followed by resolution fees if they determine they can help you.

Be wary of companies that require large upfront payments before reviewing your case. Reputable firms will offer a free consultation and clearly explain their fee structure before you commit.

Can I negotiate with the IRS myself instead of hiring a tax relief company?

Yes, you can negotiate directly with the IRS. The IRS offers several self-service options on their website, including online payment agreements for debts under ,000. For simple cases, this approach can save you thousands in professional fees.

However, complex situations involving large tax debts, business taxes, or multiple years of unfiled returns may benefit from professional representation. Tax relief experts understand IRS procedures and may identify options you’re unaware of.

How long does the tax relief process take?

The tax relief process typically takes 4-12 months, depending on your specific situation and the IRS’s current processing times. Simple installment agreements may be established in just a few weeks, while Offer in Compromise negotiations can take 6-24 months to complete.

Be suspicious of any company promising to resolve your tax issues in just a few days or weeks, as this is rarely possible when dealing with the IRS.

What credentials should tax relief professionals have?

Look for tax relief companies that employ professionals with one or more of these credentials:

- Tax Attorneys: Licensed lawyers specializing in tax law who can represent you in Tax Court

- Certified Public Accountants (CPAs): Accounting professionals with extensive tax knowledge

- Enrolled Agents (EAs): Tax specialists licensed by the IRS who have unlimited representation rights

These professionals have the legal authority to represent taxpayers before the IRS. Avoid companies that use unlicensed “tax consultants” or “specialists” without proper credentials.

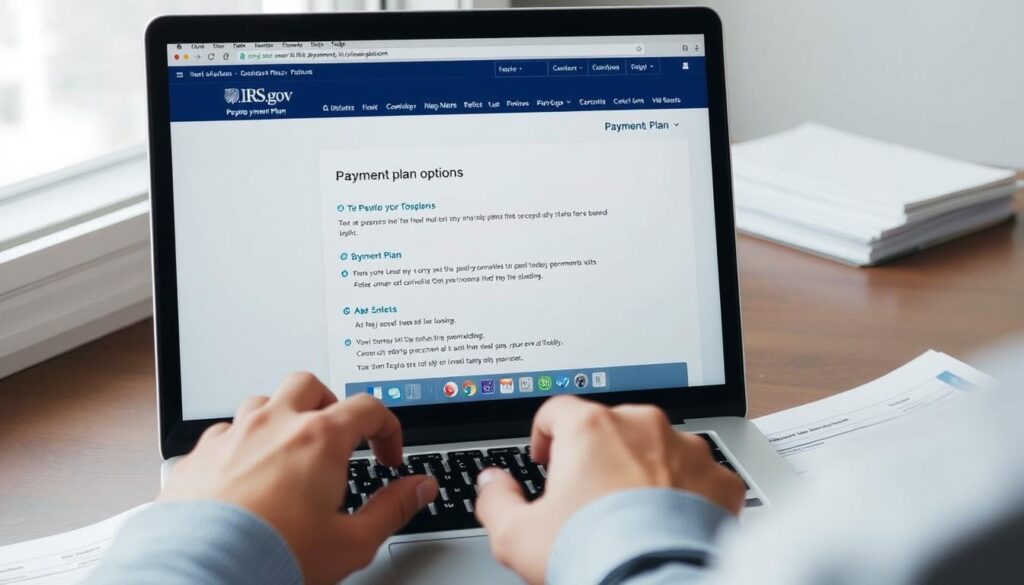

DIY Tax Relief Options

Before hiring a tax relief company, consider these do-it-yourself options that could save you thousands in professional fees:

IRS Online Payment Agreement

For debts under $50,000, you can set up an installment agreement directly through the IRS website. The process takes about 15 minutes and costs significantly less than using a third-party service.

Offer in Compromise Pre-Qualifier

The IRS provides an online tool to help determine if you might qualify for an Offer in Compromise. This can save you from paying for professional analysis if you’re clearly not eligible.

Taxpayer Advocate Service

This independent organization within the IRS helps taxpayers resolve problems with the IRS. Their services are free and can be especially helpful if you’ve faced hardship due to tax issues.

Pro Tip: Even if you decide to work with a tax relief company, gathering your tax documents and organizing your financial information beforehand can reduce your professional fees and speed up the resolution process.

How to Choose the Right Tax Relief Company

Selecting the right tax relief company is crucial for achieving the best possible outcome. Follow these steps to make an informed decision:

Final Thoughts: Making an Informed Decision

Dealing with tax debt can be overwhelming, but you have options. Whether you choose to work with one of the top tax relief experts reviewed in this article or pursue DIY solutions through the IRS, taking action is the first step toward resolving your tax issues.

Remember that tax relief companies can provide valuable expertise and representation, especially for complex cases involving large tax debts. However, they’re not magic solutions—they work within the same IRS guidelines and programs available to everyone.

Before making your decision, take advantage of free consultations offered by multiple companies to compare their approaches and recommendations. This will help you identify which tax relief expert is best suited to your specific situation.

Get Professional Help With Your Tax Debt

Don’t face the IRS alone. Get a free consultation with a top-rated tax relief company today.

Or connect with our top-rated tax relief company:

Leave a Reply